Specially thanks for the discussion with my friend Shen Lei (Jackson).

—

Disclaimer

It has been a huge increase in ALPHA token price from the all-time-low, and the author holds ALPHA positions. This article is not for financial advice.

TLDR

- If you think AlphaFinanceLab = Alpha Homora, it would be akin to saying Adobe Photoshop is Adobe. On the surface, Alpha Homora appears to be a leverage farming aggregator, but in essence, it is actually a lending platform that pretends to be a farming aggregator, which has now surpassed Aave V2 on borrowing volume. After Alpha Homora V2 launch in January (which support more assets including USDT, USDC, DAI even LP tokens), Alpha Homora’s TVL of borrowing & lending is highly possible to surpass Aave V1 + V2, entering the DeFi Lending TOP3 by TVL (Maker, Compound, and Alpha).

- If Alpha Homora intended to become a real C2C lending platform today, it only requires simple modification of the website front-end and smart contracts.

- Unlike the typical Degen latecomer’s “Sushi Paradigm”, attracting the arbitrager’s volume via liquidity mining, which cannot get the users’ loyalty in short terms (Although Sushiswap succeeded months later, it is definitely an exception for a “community fork”). Most users are using Alpha Homora as they really need to leveraging their LP tokens or earn interests on their ETH.

- Besides Alpha Homora, Alpha also has two other products, AlphaX and Alpha Asgardian, which correspond to perpetual contracts and options respectively. AlphaX will be launched on mainnet in Q1, which may still not be priced in so far.

- If there are no fatal contract security incidents like COVER, I personally believe that the probability of Alpha becoming the TOP3 DeFi Lending platform & the unicorn of on-chain derivatives in 2021 is greater than 61.8% :)

Homora: Trojan Horse Is Watching Aave

Let’s start with several points that seem unrelated: Aave seems to have become an unshakable lending leader, but Degen OGs still remember the age of ETHLend, which is a lonely child that no one loves. After introducing features such as flash loan, making efforts on compliance, it gradually entering the lending TOP 3, and one of the potential Grayscale Trust today.

Sushi, which is also one of the best performers recently. KOLs often compared it with Uniswap for various indicators. It has become a cliche that its transaction volume has reached the same order of magnitude as Uniswap. Nonetheless, the user numbers are still far away for Uniswap’s. Therefore, many people on CT still believe that Sushiswap is a whale’s game in which people like SBF may somehow pump the coins’ price while optimizing the platform’s data like the traditional penny stocks’ tricks.

Aave is formidable, but like Uniswap, it is not monolithic.

Alpha may have some characteristics similar to Sushiswap, but it will not be a hindrance for Alpha.

The Hall-of-Fame

Nipun Pitimanaaree, the Lead Engineer of Alpha, is also ranked 4th in the IMO (International Mathematical Olympiad) Hall of Fame. Nipun has participated in IMO five times and won four gold medals. Terence Tao (陶哲轩), another well-known IMO contestant, has a record of 1 gold, 1 silver, and 1 bronze medal. Although Tao is still the most exceptionally young medalists (at the age of participating), he has not been listed on the first page of the IMO Hall of Fame.

Anyway, that is to say, this CTO is definitely one of the smartest guys on the planet. If put him on the axis of the widely circulated MEME, it must be the out-and-out IQ150, as the Eastern ancient saying goes, the ignorant will never know the ambition of the great (燕雀安知鸿鹄之志), the IQ100s will never know the ambition of the IQ150s.

As our protagonist Alpha is often categorized as a yield aggregator. In this regard, many people attribute the recent pump to the fact that Alpha’s TVL has surpassed yearn’s.

If such a genius only hopes to make a small improvement on the shoulders of another genius Andre Cronje, that would be fairly underestimating the ambition of the Hall-of-Fame.

Trojan Horse

As the author is just another IQ100, he can only see the simple plots: few understand that Alpha Homora is the Trojan Horse under Aave, and unlike Sushi’s low liquidity utilization:

- If Alpha hopes to build a lending product similar to Aave. Alpha did not need to not launch a Sushi-style frontal attack on Aave like yield farming with aTokens.

- Actually, Alpha’s “lending” products have already launched in Alpha Homora, and the utilization rate is much higher than its counterparts.

Are you confused with the fact that Alpha is a lending product? Let’s start with Alpha Homora’s product design, assuming you are yield farmer Alice:

- Alice has 100 ETH and wants to farm UNI on ETH-USDT Uniswap pool, where she can normally earn 30% APY. Normally, she can swap roughly half ETH to USDT then supply them to the pool and earn 30% APY (see Alpha’s blog on how to do it optimally).

- With Alpha Homora, she can borrow 200 ETH from Alpha Homora Bank, paying the borrower’s interest rate, and together with her initial 100 ETH, she can now farm with 300 ETH (3x leverage!) — earning a total yield of 90% APY, TRIPLE! the amount of her original annual yield.*

- Without any further deposit, she can continue farming as long as her position value does not drop below 250 ETH.

- Note: Alice also needs to pay the borrowing interest on the borrowed amount, which depends on the ETH utilization rate.

If you haven’t understood it yet, it doesn’t matter. You just need to remember that Alpha Homora has integrated features including Borrowing & Lending. The current Homora V1 version only supports ETH. So what is the TVL of ETH on Homora?

Although this statistics looks simple, every figure is worth noting:

- 258k ETH deposited and 225k ETH debt issued

- 7.89% APY (not stable) with 87.64% utilization rate

Yep, 230,000 ETH, according to today’s (01–25) market price, the debt (200,000 ETH) is roughly equivalent to 260M USD. Let’s take a look at the “DeFi Blue Chips”:

As DeBank still classifies Alpha in the “Earn” category, there is no Alpha related information under the “Total borrowing volume” above. According to the earlier figure, we can conclude that Alpha Homora has actually surpassed Aave V2 and ranked 4th.

In the upcoming Alpha Homora V2, it supports borrowing Stablecoins including USDT, USDC, DAI even LP Tokens. Thus, it is highly possible that the total borrowing volume of Homora V2 will continue to grow and reach the level of Aave V1, and even surpass the sum of Aave V1 and V2 in the coming months.

It never ceased to “wow” me that Alpha reached 600M TVL in only three months.

Even when compared with Maker and Compound, Alpha Homora maintains the highest utilization rate and APY.

This APY may be more attractive than ETH 2.0 Staking at this time. Data from Binance ETH 2.0 Staking shows that the estimated Staking APY has dropped to 9.3%, which is still declining. Although I have not back-tested the relevant data, in the past few weeks, every time I open the Alpha Homora’s Earn page, the interest rate has remained at around 7–8% most of the time.

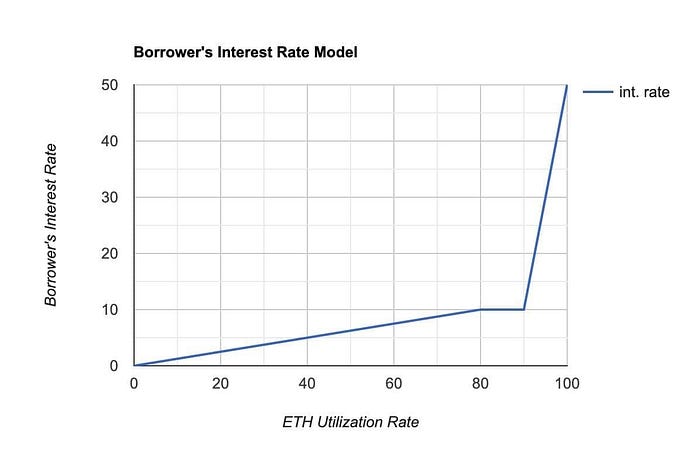

This is not a mere coincidence. Thanks to the IMO Hall-of-Fame genius’ borrower’s interest rate model, when the utilization rate is 80%-90%, the interest rate is roughly maintained at 7–8%, and when the utilization rate rises to 90+%, the slope of the interest rate curve will rapidly increase.

The design of the genius parameters and market incentives provide users with an interest rate that is far more competitive than other lending platforms and roughly equal to ETH2 staking (ETH2 staking eclipses when compared with the convenience of Alpha Homora’s deposits & withdrawals).

Meanwhile, the recent iron bank cooperation may also introduce many small-cap assets from Cream. I personally believe that this is more like a Meinertzhagen’s Haversack. Alpha needs help from Cream to bootstrapping the small-cap asset lending pools while it may eventually have its own pools in the future.

Speaking of Alpha’s ibETH TVL, we can’t miss the famous whale 0xb1, who has contributed a lot to Alpha’s TVL. If you look closely at the address log, Alpha is one of the contracts the whale has the most interactions. 0xb1 deposited a total of 67k ETH in Alpha Homora (this number was only 30k-40k weeks ago), which also shows that the whale recognizes the safety of the contract. In addition, 0xb1 also has a large number of assets on Alpha Homora for leveraging yield farming.

Perhaps some people will say that if the super whale contributes a huge proportion of TVL, will this be ephemeral or false prosperity? I think this kind of doubt is absolutely unnecessary. These remarks may be true for the comparison between Sushiswap and Uniswap in September. At that time, Sushiswap had only zombie users coming for rewards, and there were not many real transactions. But the competitiveness of lending is not the number of users, but the TVL and depth, just like many people don’t like BitMEX or OKEX, but unfortunately, if there are no black-swan type accidents, the Matthew effect is real in this field.

AlphaX & Asgardian: The Hidden Derivative Unicorn

Many may think that the product AlphaFinanceLab = Alpha Homora, or it’s just another Yearn fork with leveraging farming, but that would be akin to saying Adobe Photoshop is Adobe.

After reading the above contents, you already know that Alpha is certainly far from another Yearn fork with leveraging farming, which may have ambition beyond Aave.

But Alpha actually has another killer app, AlphaX, whose value is far from being priced in.

Why?

AlphaX (beta testnet round2) is an on-chain perpetual contract product like DerivaDAO, Perpetual Protocol, and Injective Protocol. In addition to Perpetual Protocol, which is already on the mainnet, the others are planning to release their products in Q1 (another show time lol). When compared with the market cap of these products, Alpha is not significantly higher. In fact, before this week, few people mentioned AlphaX related products on CT, which can be a perspective of still early for being priced in.

Alpha Homora (leveraged yield farming) happens to be the first. Homora could very well turn out to be its Adobe Prelude and we haven’t even gotten to its flagship Photoshop yet.

AlphaX is a decentralized, non-orderbook perpetual swap trading market. Similar to Perpetual Protocol’s vAMM, it is an improved AMM of the traditional Uniswap’s x*y=k model.

@YieldFarmerJoe had a complete and wonderful comment on AlphaX. As the saying goes, “Stop Trying to Reinvent the Wheel”, the following content is mostly quoted from his recent tweets.

Decentralized (you own your keys) non-orderbook (you’re not interacting with a buyer when you’re selling and vice versa) perpetual (this contract doesn’t have an expiration date, it lasts forever) trading market (trading market).

To keep things simple, unlike other futures (puts and calls), which have settlement dates, a perpetual contract — as the name suggests — lasts forever. So they are very much like buying SPOT. However, you do not hold the underlying token.

Perps keep pegged to the underlying asset through a funding rate. At reg intervals, either the LONG/SHORT side of the trade pays the other (the less popular side) a premium (grows the further away from SPOT) to give incentive for the less popular side to be more popular.

So over time if you’re on the popular side, you’ll be paying quite a bit the longer you stay in and the more popular the side you’re on is.

AlphaX’s 1st unique selling point:

It doesn’t matter how long you hold it for — even if you’re on the popular side — there is no funding rate.

Instead, it’s baked into the buy and sell price. So it only matters WHEN you buy or sell. The premium or discount at the buy and sell price provides the incentive/disincentive to bring the price closer to the asset’s spot price.

This makes for much easier simplification and a lot less babysitting. You only need to pay attention to WHEN you buy and sell instead of every 8 hours or every day (or whatever the funding payment occurs for the exchange you’re on)

The second advantage of AlphaX and I believe more exciting is tokenizing the perp as an ERC-20 token. You don’t have to open it on AlphaX. After anyone does, they can trade it on any secondary market (Uniswap / Sushiswap)

So you can hold a leveraged perpetual token OF a token, not have to worry or think about funding rates & trade-in & out of it on popular DEXES & only look at its current price to make your decision. Imagine buying a baked in leveraged token of BTC easily on uniswap.

Keep in mind the increased risk, b/c unlike spot, there is a price where your token is liquidated & becomes worthless.

That liquidation price is clearly written in the token name and it’s closer and closer to the current SPOT price the higher you choose to leverage.

AlphaX’s products will reach more people because it leverages Ethereum‘s money legos.

You don’t need to log into AlphaX or Perpetual Protocol or Injective protocol. The Total Available Market or demand for the product is tapped into the DEX market size.

Besides AlphaX, if you have followed AlphaFinanceLab’s Github account, there is also another easter egg. It is a GitHub repository called Alpha Asgardian.

From the prototype, it seems that users can customize the options to reduce the IL (Impermanent Loss) of LP tokens after connecting to the wallet and a simple click of MAX, let alone the elegant UI.

(Noting: Alpha Asgardian is not on the official roadmap or website of Alpha Finance Lab, it may be something like an internal Hackathon. So, it may still have a long way to go till launch.)

It’s beautiful.

And it’s inevitable.

—

Sources: